What is E-liability? What are E-assets?

Climate change is one of the world’s most urgent issues and organizations must be on the front line for decarbonizing the economy. However, current approaches to corporate carbon accounting do not identify the opportunities for individual entities to reduce actual emissions created through their own operations or purchased from their suppliers.

Learn more about E-liability accounting and how it supports organizations to continuously reduce their own supply chain emissions through innovations in operational and sourcing decisions.

What is E-liability?

The E- (or environmental-) liability approach was developed by Professors Robert Kaplan (Harvard) and Karthik Ramanna (Oxford), co-founders of the E-liability Institute. Professors Kaplan and Ramanna first published the idea in the November/December 2021 issue of the Harvard Business Review and it won the journal’s 2022 McKinsey Prize for “groundbreaking management thinking.”

E-liability is an accounting algorithm that allows organizations to produce real-time, accurate, and auditable data on their total direct and supplier emissions, and those for any of its products and services. It is a simple, open-source, free-to-use set of principles that should be the basis of any sound carbon-accounting standards.

The E-liability approach produces, for every product and service in the economy, an accurate and auditable measure of its total “cradle-to-gate” carbon footprint. This allows every purchaser – whether a company acquiring a batch of cement, a consumer buying a movie on their tablet, or a green investor looking for their next project – to measure the total carbon emitted into the atmosphere in creating that specific product or delivering that specific service.

Want to learn more?

How does it work?

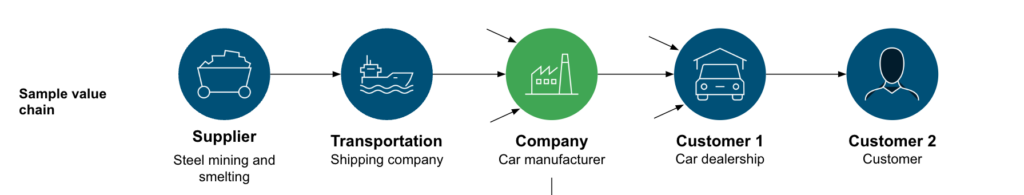

To illustrate, consider a car door manufacturer. The company has many suppliers for the sheet steel, glass, plastics, fabric, and electronic components that are assembled into the door. Under the E-liability method, as each of these components arrives at the car-door factory, their accumulated emissions are transferred from the suppliers to the company. The company next adds its own direct emissions from its production and assembly stages, such as the energy it uses to process the materials. All the emissions, both transferred from suppliers and used on-site, are then assigned to its various door products, similar to a standard accounting practice that assigns the cost of materials and overheads to finished products.

The total emissions used to make and transport a finished car-door are finally transferred to the next company in the value chain – the car-assembly factory – when the door is sold to that factory. Thus, in a method similar to how value-added taxes work, the E-liability approach also resolves the multiple-counting problem in current carbon-accounting protocols.

Information technologies such as blockchain, combined with existing inventory and cost-accounting systems, can record, transmit, and provide an audit trail for E-liability transactions. And the emissions data for each product will automatically aggregate into company-level accounts – just like in financial reporting. The data can be presented in a similar format as a financial balance-sheet, making it easy for independent analysts to verify.

How is it different?

Unlike a standard and static EPD/product life-cycle emissions report, which some companies currently produce about every three years, the E-liability approach produces dynamic, real-time reports on all of a company’s products, based on its current processes, sourcing, and designs. The E-liability approach provides strong incentives for innovations in real-time carbon reduction.

The current GHG Protocol Scope 3 standard was designed in the early 2000s to inspire organizations to action, but not as an accounting solution. The standard’s entity-level approach to carbon accounting means that collecting “supplier-specific” Scope 3 data is impossible for any sizable company in a modern value-chain. The standard then allows companies to supplement primary data with industry-average data. The result enables guesstimates and gaming of GHG accounts.

Applying the Scope 3 standard also results in counting the same value-chain emissions multiple times, giving organizations little incentive to understand and reduce the total emissions under their control. This is analogous to FASB/IASB allowing a company to report its own profits as a share of the profits of all its suppliers and customers. In effect, Scope 3 data are not actionable for strategic decisions and can result in misleading users and misallocating green capital to underproductive investments.

The E-liability solves the problems of multiple-counting and guesstimates in current carbon accounting practices and allows organizations to produce real-time, accurate, and auditable data on cradle-to-gate emissions for any of its products and services.

E-liability accounting also generates accurate and auditable information for external stakeholders – customers, shareholders, consumers, regulators, and communities – to monitor and hold accountable corporate progress in achieving their NetZero pledges. It supports reporting and compliance with regulation, such as the EU’s Carbon Border Adjustment Mechanism, by providing a taxable basis for relevant products that is accurate and verifiable.

What are E-assets?

E-assets refer to accurately measured and verified carbon offsets recognized on organization’s environmental balance sheets. The E-asset system introduces principles for efficient markets, such as managing E-balance sheets, auditing for a “true and fair” representation of carbon emissions, and creating diversified portfolios of removal offsets. It ensures transparency in the economics of producing carbon offsets and deters offset producers from walking away after selling future carbon capture.

Financial accounting principles are used in the system to define what constitutes a carbon-offset asset:

– When can such an offset be traded in arms’-length exchanges;

– When can the asset be used to extinguish emissions liabilities; and

– Who bears responsibility for reporting offset impairments after the underlying assets are destroyed, for instance, due to fire or deforestation.

The E-asset system addresses challenges in current carbon-offset markets, including inconsistent reporting, lack of auditing, and the risk of mismanagement. It promotes transparency, accountability, and efficiency in carbon accounting, offering a more robust and reliable framework. The system also considers the financial implications of selling long-lived E-assets and explores innovative funding mechanisms.

The E-ledger system

Together, E-assets and E-liabilities provide the basic accounting tools for organizations and governments to measure and manage their performance toward decarbonization targets. Importantly, when an entity’s E-liabilities are netted against its earned E-assets, the result is a quantifiable measure of the entity’s Net Zero performance. The E-Asset and E-liability system work together by establishing clear reporting systems, auditing procedures, and offset portfolio management.

This comprehensive approach provides a foundation for a market-based solution to combat climate change by reducing atmospheric carbon emissions. The principles aim to bring order to the current offset trading landscape, leveraging human competition and innovation to meet the challenge of reducing atmospheric carbon.